are inherited annuity distributions taxable

Another tax-savvy way to use RMDs is to wait until late in the year then direct the IRA provider to pay all or most of the RMD. Tax-Sheltered Annuity TSA Roth Conversion IRA Inherited Beneficial IRA Full 100 Specific Amount.

Inheritance 401 K A Guide To Inheriting A 401 K District Capital

Purchase an annuity Some who receive a life insurance death benefit of course need those proceeds to help pay for monthly living expenses.

. If an annuity contract has a death-benefit provision the owner can designate a beneficiary to inherit the remaining annuity payments after death. Required Minimum DistributionsCommon Questions About IRA Accounts Internal Revenue Service. Each annuity in this series comes with a death benefit equal to the full value of the contract in a lump sum.

A nonqualified variable annuity allows you to defer taxes on your investment gains but doesnt entitle you to a tax deduction as a qualified plan does. Publication 590-B Distributions from Individual Retirement Arrangements. The IRS proposed regulations on required minimum distributions published on February 24 2022 1 would require distributions to be made on a at least as rapidly basis during the 10-year period and then a complete distribution in year 10 provided the deceased employee or IRA owner was over the age of 72 or 70½ if born before 711949.

Are my social security benefits taxable by New York State. The taxable annuity shown on Form CSA 1099-R doesnt reflect this exclusion. Are my social security benefits taxable by New York State.

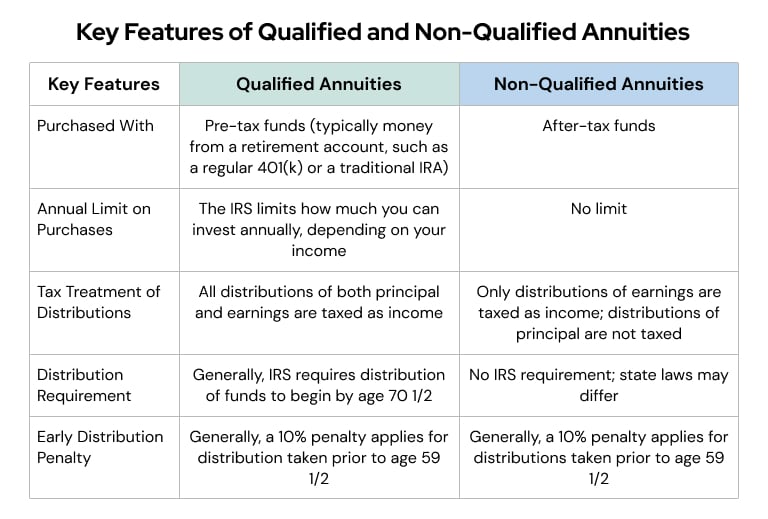

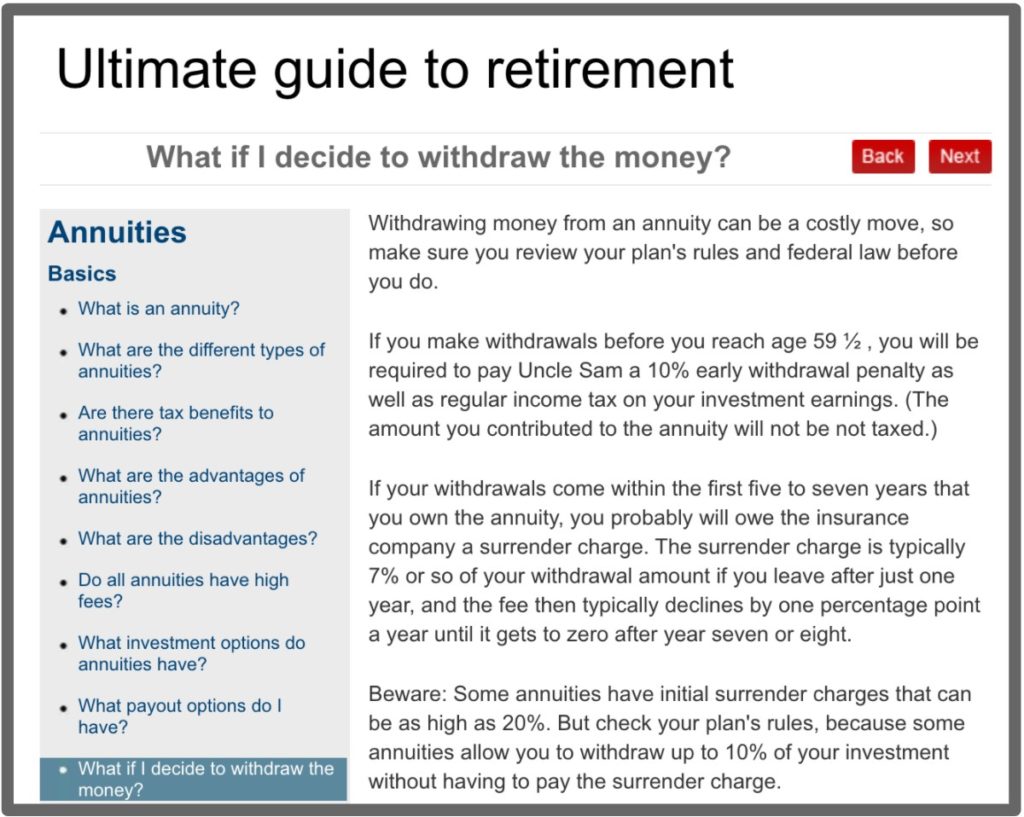

If total withholding is not adequate you. The SECURE Act changed the inherited IRA rules for beneficiaries who werent married to the original account owner. The 10 penalty tax generally applies to the taxable amount of distributions from annuities made before the owner attains age 59½.

Inherited IRA rules for non-spouses. Retirement Topics Required Minimum Distributions RMDs Financial Industry Regulatory Authority. If you make this election reduce the otherwise taxable amount of your annuity by the amount excluded.

An inherited IRA may be taxable depending on the type. A Complicated Simple Question. In the past a beneficiary could take distributions over their lifetime.

IRA FAQs - Distributions Withdrawals Internal Revenue Service. If you inherit a Roth IRA youre free of taxes. The earnings on an inherited annuity are taxable.

The beneficiary may be taxed on distributions made from an annuity after the owners death. The funds within the variable annuity can be allocated. And the IRA is subject to section 401a9B.

The death of a contract. This strategy was known as the Stretch IRA In some cases beneficiaries would simply take the original owner. Qualified annuity distributions are fully taxable.

The earnings come out and are taxed first and the basis comes out after the earnings are exhausted. Answer ID 611 Updated 12032019 0853 AM. Lump-sum distributions withdrawals from non-qualified annuities are broken down into basis and earnings.

How do I avoid paying taxes on an inherited annuity. I am thinking of cashing in my mutual funds that I inherited from my mother not employer related to buy an. Like other investment products a variable annuity can be held in either a taxable account or in a tax-advantaged qualified retirement plan.

If that transfer is made pursuant to section 402c11 the distribution is treated as an eligible rollover distribution. Report your total distributions on Form 1040 1040-SR or 1040-NR line 5a. Forethought fixed annuity rates range from 125 to 250 as an average.

Compared to other fixed annuity contracts SecureFore fixed annuities rank lower on the annuity rate spectrum. But with a traditional IRA any amount you withdraw is subject to ordinary income taxes. Distributions in Year of Retirement.

Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022 as applicableIn previous years distributions and repayments would be reported on the applicable Form 8915. You are liable for federal income tax on the taxable portion of your distribution. That may be particularly true for young families that need to replace the breadwinners paychecks or for retirees who lost a second source of household income when their spouse died and stopped.

Social security benefits as well as Tier 1 railroad retirement benefits included in your federal adjusted gross income are exempt from state and local income taxes. An annuity is a financial instrument issued and backed by an insurance company that provides guaranteed monthly income payments for the life of the contract regardless of market conditions. Form 8915-F replaces Form 8915-E.

Report the taxable amount on Form 1040 1040-SR or 1040-NR line 5b. The IRA is treated as an inherited account or annuity as defined in section 408d3C so that distributions from the inherited IRA are not eligible to be rolled over. How inherited annuities are taxed depends on their payout structure and whether the one inheriting the annuity is the surviving spouse or someone else.

Consent of spouse is required for distributions from 403b plans that are subject to ERISA. SPIAs are also beneficial for younger people who have inherited a large sum of money and wish to protect the windfall from poor financial management. Forethought Fixed Annuity Rates.

Qualified Vs Non Qualified Annuities Taxes Distribution

Distribution Options For Inherited Non Qualified Annuities Bsmg Brokers Service Marketing Group

Inherited Annuity Commonly Asked Questions

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Inherited Annuity Tax Guide For Beneficiaries

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja Deduction Standard Deduction Inherited Ira

Annuity Beneficiaries Inherited Annuities Death

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Taxation How Various Annuities Are Taxed

How Are Inherited Annuities Taxed Annuity Com

Inheritance 401 K A Guide To Inheriting A 401 K District Capital

Do I Have To Annuitize My Annuity Income Annuity Annuity Quotes Lifetime Income

Annuity Beneficiaries Inheriting An Annuity After Death

How To Avoid Paying Taxes On An Inherited Annuity

Qualified Vs Non Qualified Annuities Taxation And Distribution

End Of Year Contribution And Distribution Planning For Tax Favored Accounts Https Www Kitces Com Blog End Of Year Contribution Di End Of Year How To Plan Ira

Inherited Annuity Tax Guide For Beneficiaries

Non Spouse Beneficiaries Rules For An Inherited 401k Inherited Ira Investing For Retirement Traditional Ira